Helping Businesses...

OUR FUNDING PARTNERS’ CREDENTIALS

GET FUNDED IN 1-2-3 EASY STEP

Checking your rate won’t affect your credit score

Apply Online

- Fast & Easy Online Application Our loan specialist will contact you Or call us at our phone number: (512) 358-1511

Review Your Options

-You will have options to get funding in minutes

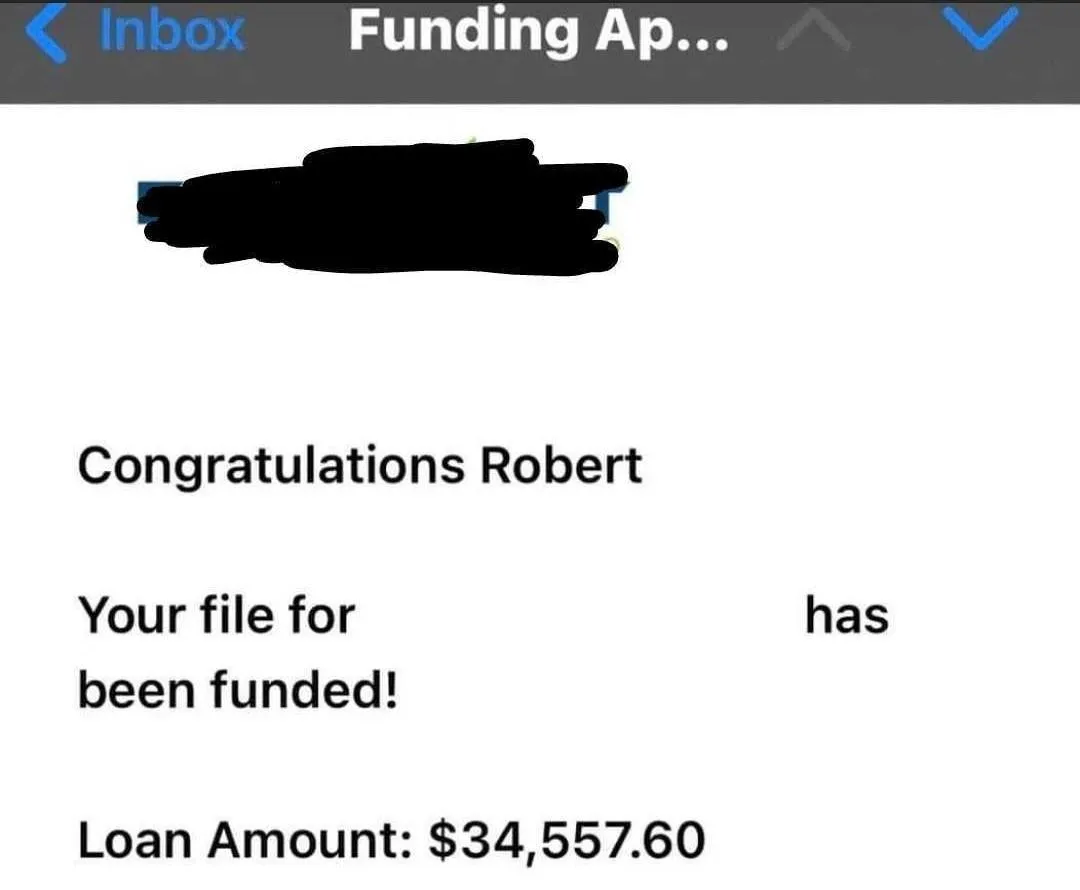

Get Funded!

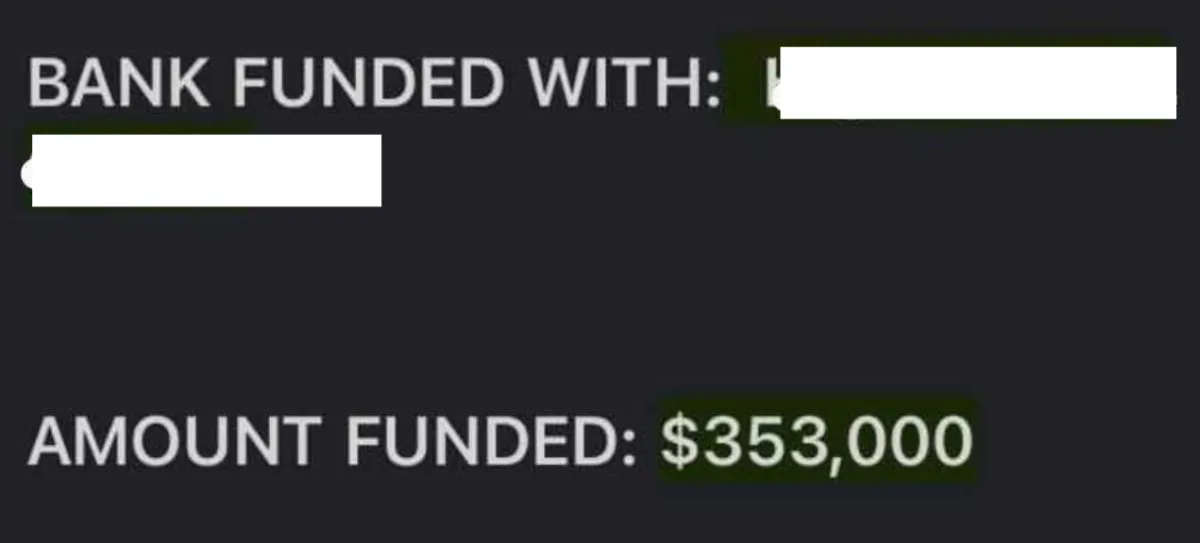

- Loans – $125,000 – $5,000,000

Receive funding in as fast as 1 day

GET FUNDED IN 1-2-3 EASY STEP

Checking your rate won’t affect your credit score

Apply Online

- Fast & Easy Online Application Our loan specialist will contact you Or call us at our phone number: (512) 358-1511

Review Your Options

-You will have your decision in minutesNo paperwork, no waiting

Get Funded

- True term loans – $5,000 – $1,000,000 Receive funding in as fast as 1 day

FAST, EASY, RELIABLE

10,000+

Business Served

$2 billion+

Funds Delivered

Customer Reviews

FUNDING OPTIONS

Find the business loan that meets your needs

EQUIPMENT FINANCING

Get funding to purchase equipment for you business to keep on growing.

WORKING CAPITAL

Quick and simple cash available for any business purpose.

TERM LOAN

Our specialists will tailor a business loan to fit your needs.

SBA LOAN

Lowest rates available with an SBA 7a,504,or express loan.

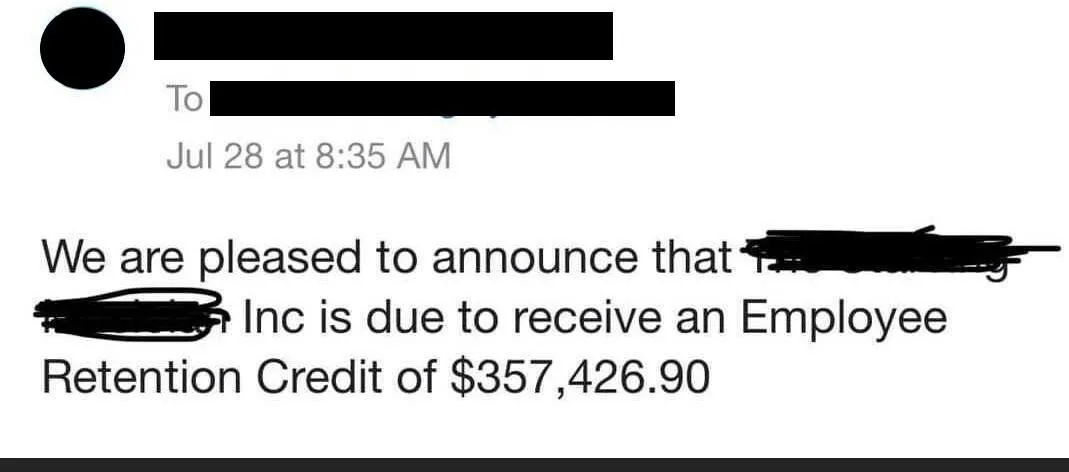

EMPLOYEE RETENTION TAX CREDIT (ERTC)

If your business had employees through 2020 and 2021 you may qualify for up to $26,000 per employee.

INVOICE FACTORING

Get paid upfront for your 30-60 or 90 day old invoices.

BUSINESS LINE OF CREDIT

Access capital for your business when you need it and only pay interest on the funds you use.

TRUSTED PARTNERSHIPS

WITH OVER 50+ LENDERS

EXCLUSIVE PARTNERSHIPS

THAT YOU CAN COUNT ON

At Commercial Capital LTD, we appreciate how investing in relationships brings mutual prosperity. Who we partner with ensures the best services available for our customers.

To discuss potential opportunities, please call

(512) 358-1511

WHAT OUR CUSTOMERS ARE SAYING

Industry leading approval process that is easy and less intensive. Get the capital you need to allow your business to grow, today!

Speak to a Karen Schimpf Now

(512) 358-1511

Commercial Capital LTD © 2023 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at https://www.bizloansconnections.com are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.